Expert Tax Services with a Family Touch

Welcome to C&C Taxes. We aren't just a tax firm; we are a father-daughter team dedictated to serving our community. Whether you are a Spanish-speaking family navigating the tax system or a veteran seeking clear financial guidance, we are here to offer trustworthy support.

About Us

C&C Taxes LLC was founded on a simple premise: Everyone deserves tax services that are clearn, honest, and accessible. Blending military discipline with compassionate community service, we created a firm that treats every client like family.

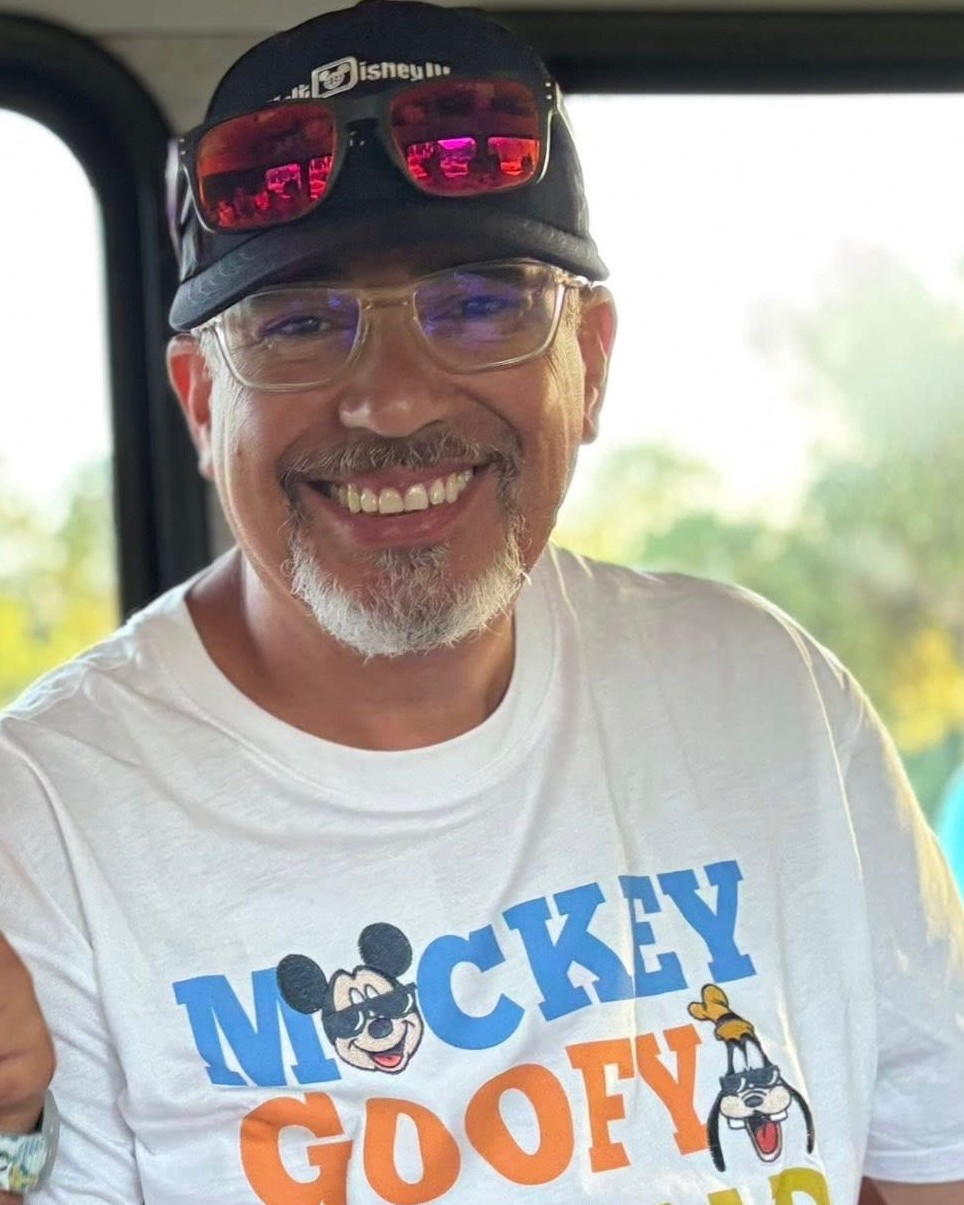

Meet the Team

C&C Taxes was founded by a father–daughter team, blending Celine’s six years of tax experience and her passion for helping Spanish-speaking clients with Charles’s military service and business expertise. Together, they created a veteran-owned and Hispanic-owned firm dedicated to breaking language barriers and offering honest, understandable tax services to their community.

Celine has been preparing taxes for six years and is nearing completion of her bachelor’s degree in accounting. After repeatedly witnessing the language barriers faced by Spanish-speaking clients, she was inspired to create a business that offers clear, accessible, and trustworthy tax support for her community.

Charles is a retired Army veteran with a Bachelor of Arts in Business Administration and two years of tax preparation experience. After witnessing the language barrier in the community and the lack of financial guidance provided to soldiers, he was motivated to help build a business that offers clear, knowledgeable, and trustworthy tax support.

our services

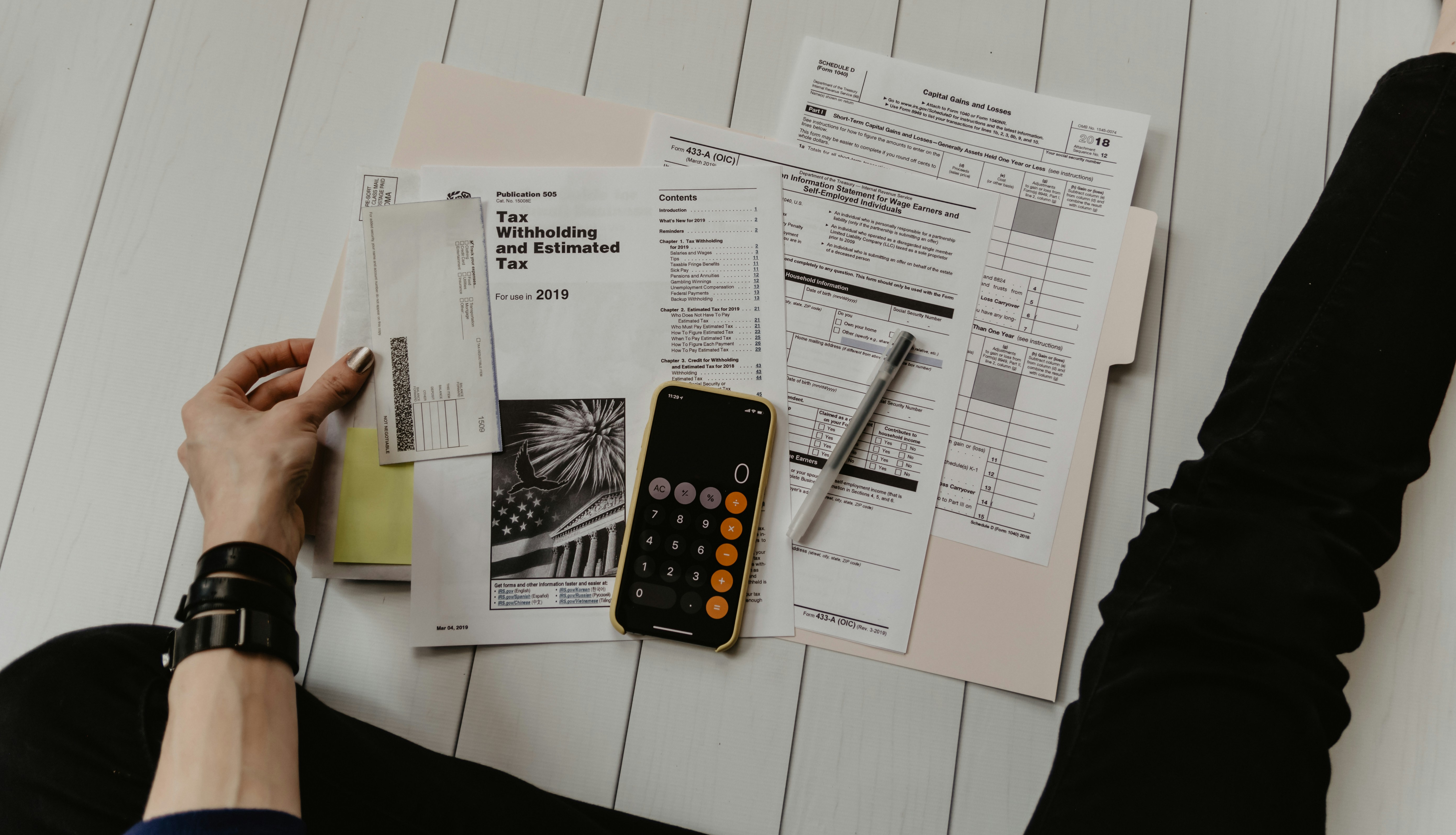

Expert Tax Preparation Services

Provide personal and business tax preparation, filing, and compliance guidance with bilingual support and affordable pricing.

Account Services

Provide accurate bookkeeping, payroll, and financial reporting to help clients stay organized and compliant year-round.

Contract Services

Offer bilingual contract drafting, review, and negotiation support for individuals and small business owners.

Business Consulting

Help clients start and grow successful small businesses with strategic guidance and professional setup support.

Notary & Document Certification

Provide notarization, certification, and verification for legal, tax, and business documents.

Translation & Interpretation

Offer professional bilingual translation and interpretation for financial, legal and business contexts.

Financial Education & Training

Educate the community through bilingual workshops, webinars, and coaching programs focused on financial literacy and small business skills.

What Our Clients Are Saying

Discover why our clients trust us with their tax needs year after year. From individuals to businesses, our personalized and professional approach has made a lasting impact. Read their stories and see how C&C Taxes LLC has helped them navigate the complexities of taxes with ease and confidence. Your success is our success.

Choosing C&C Taxes LLC for my tax needs was a game-changer for my small business. The team's expertise in handling complex tax situations made a significant difference in optimizing my deductions and ensuring compliance.

JANE DOE

I used to dread tax season, but that all changed when I found C&C Taxes LLC. Their user-friendly online platform made filing a breeze, and their team went above and beyond to answer my questions promptly. They found deductions.

JANE DOE

I've been entrusting my tax needs to C&C Taxes LLC for years, and they continue to impress me with their expertise in real estate taxation.

They found deductions I never knew existed, resulting in a larger refund than I expected.

JANE DOE

FAQS

How can I file my taxes with C&C Taxes LLC?

Filing your taxes with C&C Taxes LLC is easy and convenient. Simply visit our website and create an account if you haven't already. From there, you can access our user-friendly online platform, where you'll be guided through the tax filing process step by step. Our platform is designed to make it as straightforward as possible, and if you ever have questions or need assistance, our expert team is just a message or a phone call away. We're here to support you throughout the entire process.

What documents do I need to provide for tax preparation?

To prepare your taxes accurately, we need various documents, including W-2s, 1099s, receipts for deductible expenses, mortgage interest statements, and records of other income or investments. Please also bring your previous year's tax return for reference.

How can I be sure my tax return is accurate?

Our team of experienced professionals follows meticulous procedures to ensure accuracy. We stay updated with the latest tax laws and double-check every return. Additionally, our services include a review process to catch any potential errors before submission.

What should I do if I receive a tax audit notice?

If you receive a tax audit notice, contact us immediately. Our experts will guide you through the process, help you understand the notice, and represent you during the audit to ensure your interests are protected.

How can tax planning benefit me or my business?

Tax planning helps you make informed financial decisions throughout the year, potentially reducing your tax liability and maximizing savings. Our personalized tax planning services ensure that you take advantage of all available deductions, credits, and strategies tailored to your unique situation.

Can you help me if I need an extension to file my taxes?

Absolutely. We offer hassle-free tax extension services to ensure you meet IRS deadlines. We handle all the necessary paperwork and submit your extension request, giving you extra time to prepare your tax return accurately and avoid penalties.

Get In Touch

Email: [email protected]

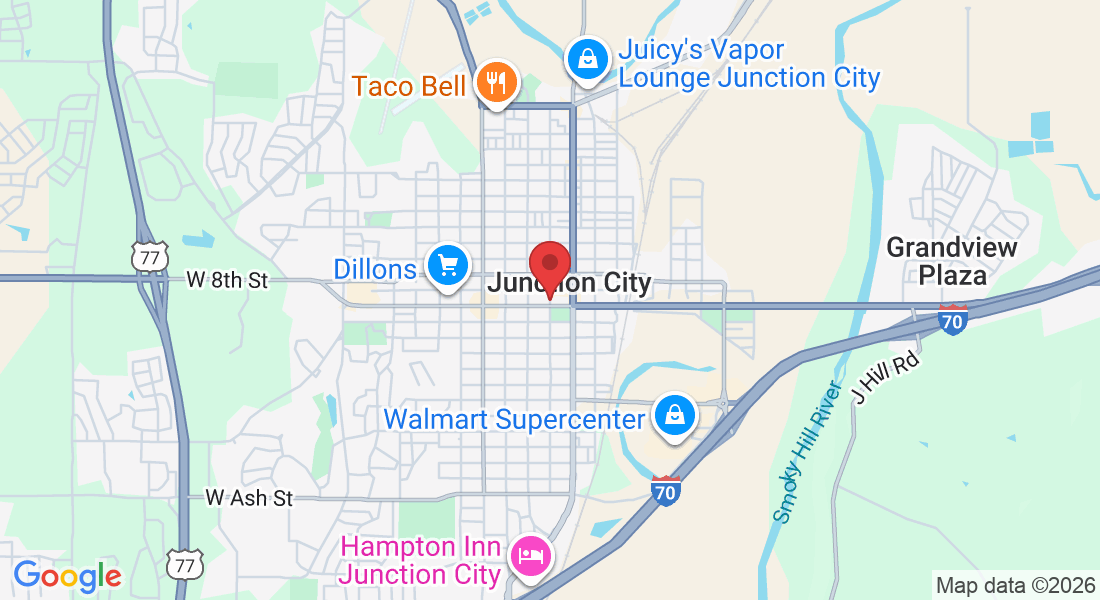

Address : 1101 Meadowbrooke Lane, Junction City KS 66441

Operating Hours:

Mon – Thu 10:00am - 8:00pm

Fri – Sat 10:00am - 2:00pm

Sunday – CLOSED

Email: [email protected]

Phone : (785) 253-9722

Address : 1101 Meadowbrooke Lane, Junction City KS 66441